With me, a passing interest (and a few hours at a computer to Google) can quickly turn into a complete obsession. So, along with my newfound SAVER attitude, and armed with Google, I have found many ways to save the pennies along the way as well as the bigger dollars.

MONEY SAVING TIPS:

1. The Spare Change Jar.

Every time Husband or I have spare change, we put it into a piggy bank for the Kids. I even made my own bank that has 4 parts to it – INVEST, SAVE, TITHE, SPEND. Invest goes into their bank accounts once a month (along with an extra $20 or so from Momma Bear) or so (NOT to be touched until they are about 30); Save is there for the next big holiday; Tithe is money they carry to Sunday School, or children’s charities; Spend is cash, baby. We figure their Invest accounts will get up to a downpayment for a house by the time they’re 30. Kids great-grandmother even saves all her pennies for us.

2. The Pop Bottles.

Kids pilfer the grandpa’s house then head with all our bottles out once a month to the return depot. It’s gross. Slimy. GERMY. But, it adds $20/m or so into their Invest section.

3. Plant a Garden.

3. Plant a Garden.

This is my “Spring” plan for those Heirloom tomatoes that make such lovely salads. We eat a ton of tomatoes and raspberries, so I’ll start by planting those two and see if I can manage to keep them alive. (Hey, I’ve kept those danged feeder fish alive for almost 3 years, anything’s possible…). And at the prices of those tomatoes these days, there’s gotta be a good monthly savings out there. Besides, Kid #4 loves to be outdoors, so maybe I should get out there once in awhile too.

4. Coupons.

I hate coupons. I make a valiant effort once in a blue moon to find them and cut them out, just to leave them at home when I’m out shopping. So, I’m only going to look for coupons for the things I use THE MOST and give it one more best effort.

5. Have an automatic withdrawl into a savings acc’t.

I looked at the numbers for this, and I’m not really sure it makes a whole lot of difference in the long run unless you tuck away at least $100-200/m. And we might still miss that right now, so maybe this is one for 2010. Well, maybe if we start now but at $50/m it’ll still add up to the trip to Greece… or back to Florence… when we retire.

6. Bake bread.

This, I’ve realized, isn’t so hard since we actually HAVE a bread-maker! And the 12-grain whole what-ev-er kind of bread we buy is up to $4.70 per loaf – times 2 per week! So, maybe sticking in some ingred’s before bed once in awhile won’t be so hard. And could save a few more pennies. Maybe Husband can take this one on.

7. Use newspaper cartoons as wrapping paper. $4/wrapping x 10 relatives per year…

They just tear it up and toss it out anyhow, so why not.

8. Make your own cards. $4/card x 20 relatives per year…

They just toss ’em out anyhow, so why not.

9. Freeze food.

Bananas (for smoothies), Garlic, Fresh-squeezed Lemon juice (in cubes), etc.

We throw out a LOT of food, so freezing it in useable bits has gotta save SOMETHING.

10. Go to the Library.

This is for other people, not me.

For me, Libraries are horribly expensive places that I cannot afford.

Chapters is my Library. Besides, the one near us also has a Starbucks and a train table…

And even THEN it’s cheaper than paying my late fees!

11. Pack your lunch.

We mostly do this already, b/c it’s just plain healthier.

12. Make your coffee at home.

YAY for Starbucks Barista Machines!! Woot, Woot!

13. Walk more.

Now, with homeschooling, we actually can! No daily drive to drop off/pick up, except Kids #1 and #2 a few times a week. And, sometimes we actually just WALK for the day rather than drive about. Believe it or not.

14. Pay mortgage payments bi-weekly.

Just read this one… It means two extra payments over monthly payments, per year. ?? Will have Husband look into that one.

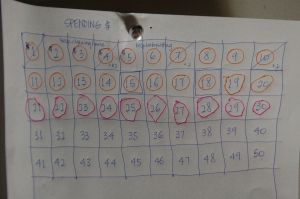

15. Record every purchase.

This will only serve to HIGHLIGHT the multiple trips to Starbucks a week… (and unnecessary trips when you have a machine sitting right at home!!).

16. Buy offseason.

I try to buy the boys’ clothes on sale a season in advance. But then, they’re boys. They don’t much care what they wear and they pretty much wear the same things every year. The girls had been much different…

17. BOXING DAY SALES.

Buy gifts for the year (birthdays, anniversaries, even next Cmas!) all during the big sale week and stockpile them. Also you don’t have to worry about last-minute stress of having to find s’thing for a last-minute party that you’d completely forgotten about.

18. Cut your own lawn.

Ya, we let go of the gardener, too…

19. Promotion Code.

Just read this one, too – Grama probably already knows it. When buying online, Google the store and the words “promotion code” and you’ll almost always get a hit for saving some $$ on your purchase, even if it’s just for shipping. Hmmmmmm. Shopping online… Wonder if I can buy them knee-high black leather boots online…

to be continued…

Filed under: Money Honey | Tagged: Money Honey | Leave a comment »

.

.

Hubby has a “big” birthday coming this summer which I won’t mention TOO many times because he says it’s starting to depress him. BUT, what can cure the blues like a vacation in Maui?? HOPEFULLY there is enough money left/saved to book 5-7 days in Maui. And maybe even to hit a tacky touristy LUAU to sing in his new decade.

Hubby has a “big” birthday coming this summer which I won’t mention TOO many times because he says it’s starting to depress him. BUT, what can cure the blues like a vacation in Maui?? HOPEFULLY there is enough money left/saved to book 5-7 days in Maui. And maybe even to hit a tacky touristy LUAU to sing in his new decade.